In rare cases, a device may be unable to deliver consistent performance due to its design. Some systems may perform more consistently than others. The precision of UL benchmark scores is usually better than 3%. UL has not tested every configuration explicitly. FPS speeds estimated at a higher speed than the hardware max speed will require an external display capable of reaching those speeds.īenchmark scores are provided by UL based on the system specifications.

Actual FPS speeds are dependent on display refresh speeds. The frames rate is an estimate rather than exact performance and is an average of in-game frame rates observed during testing. Screen refresh speed is not factored into the calculation. Frames per second values will vary based on combinations of graphics card, processor and screen resolution selected in the configuration tool. Laptops Frames Per Second (FPS), calculations are benchmark scores tested by UL based on system specifications.

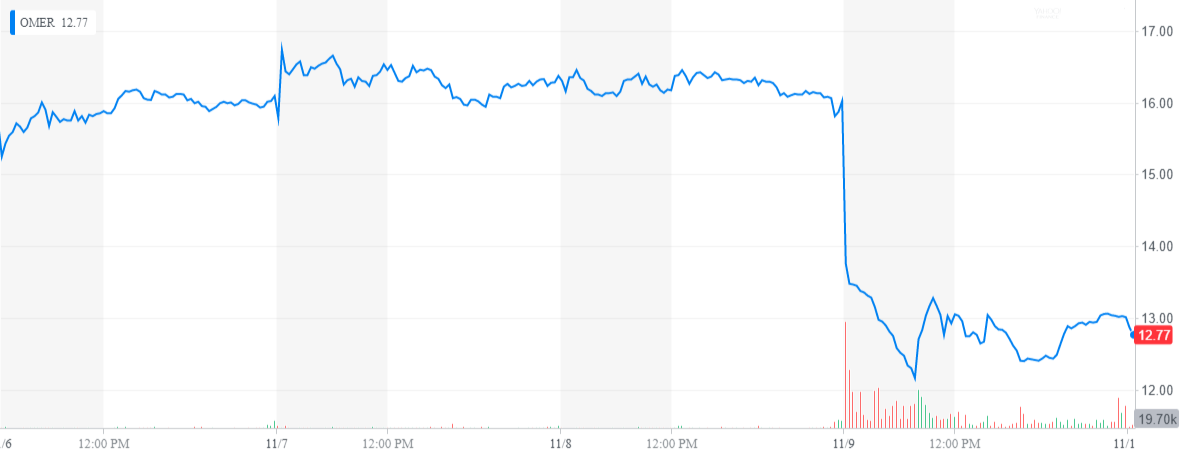

#Omer stock Pc

Actual desktop PC FPS speeds will be dependent on the user’s display and it’s refresh speed. The FPS rate is an estimate rather than exact performance and is an average of in-game frame rates observed during testing. and/or other countries.Ģ. Desktops Frames Per Second (FPS), calculations are benchmark scores tested by UL based on system specifications. Ultrabook, Celeron, Celeron Inside, Core Inside, Intel, Intel Logo, Intel Atom, Intel Atom Inside, Intel Core, Intel Inside, Intel Inside Logo, Intel vPro, Itanium, Itanium Inside, Pentium, Pentium Inside, vPro Inside, Xeon, Xeon Phi, Xeon Inside, and Intel Optane are trademarks of Intel Corporation or its subsidiaries in the U.S. Intel, the Intel Logo, Intel Inside, Intel Core, and Core Inside are trademarks of Intel Corporation or its subsidiaries in the U.S. When taken as whole, stock gets a rating of Overweight and that encourages the investors to exploit the opportunity and build their stake up in the company.1. Recommendation by 0 analysts for the stock is an Underweight while number of those analysts who rated the stock as an Overweight is 0, whereas 1 of them are considering the stock as a Sell. Long term indicators are suggesting an average of 100% Sell for it.Īccording to ratings assigned by 6 analysts at the scale of 1 to 5 with 1.00 representing a strong buy and 5.00 suggesting a strong sell 3 of them are recommending Omeros Corporation (OMER) as a Hold, while 2 are in view that stock is a Buy. In contrast, when we review OMER stock’s current outlook then short term indicators are assigning it an average of 50% Sell, while medium term indicators are categorizing the stock at an average of Hold. In last 7 days, analysts came adjusting their opinions about stock’s EPS with no upward and no downward revisions, an indication which could give clearer idea about the company’s short term price movement. These estimates are suggesting current year growth of -20.10% for EPS and 16.70% growth next year. with estimates of that growing to -$1.79 in next year. Analysts are in estimates of -$0.64 per share for company’s earnings in the current quarter and are expecting its annual EPS growth moving up to -$2.

With its current market valuation of $249.59 million, Omeros Corporation is set to declare its quarterly results on – Mar 04, 2022. Simply click here and the name & trading symbol are yours. and that's excellent news for individual investors like you who have the foresight to act decisively on an emerging megatrend that's already being measured in the Tens of $Billions. and the Chinese can't do a damn thing about it! It's early stage. Here's one little-known company - trading undiscovered below 25-cents per share - that's advancing one of the largest and highest quality REE deposits in all of North America. China Can't Stop US$0.25 Stock from Mining Ultra-Rare Metal

0 kommentar(er)

0 kommentar(er)